Installers play a critical role in helping customers access Battery Subsidies by simplifying eligibility checks, managing documentation, and aligning approved energy storage products with regional incentive programs. In 2026, effective subsidy assistance directly influences purchasing decisions, project approval speed, and installer competitiveness across key global markets.

2026 Installer’s Guide: How to Help Customers Secure Energy Storage Subsidies in Australia, the UK, and Italy

In 2026, Battery Subsidies remain a decisive factor accelerating residential and small commercial energy storage adoption. Installers are no longer only technical service providers; they increasingly act as subsidy advisors. By understanding policy transitions, incentive mechanisms, and compliance requirements in Australia, the UK, and Italy, installers can reduce customer friction, shorten sales cycles, and deliver measurable financial value alongside reliable energy storage solutions.

Why Mastering Subsidy Assistance Is the Ultimate Sales Tool for Installers in 2026

Battery Subsidies have shifted from being optional incentives to becoming core purchase drivers. Customers now expect installers to explain not only system performance but also return on investment after subsidies. Installers who can clearly quantify savings, pre-screen eligibility, and guide applications gain higher trust and close rates. According to market trends highlighted by hicorpower.com, installers that integrate subsidy expertise into their sales process consistently outperform competitors relying on price-only strategies. In 2026, subsidy mastery strengthens differentiation, supports premium product positioning, and builds long-term customer loyalty.

Compliance and Documentation: The “Must-Have” Checklist for Approved Products

To successfully access Battery Subsidies, installers must ensure strict compliance. Key documentation typically includes certified product datasheets, safety and grid compliance certificates, inverter compatibility confirmations, and installer accreditation records. Clear installation photos, commissioning reports, and serial number tracking are also mandatory. Products must appear on approved government or utility lists, and documentation accuracy directly impacts approval timelines. A standardized checklist reduces rejection risks and ensures installers remain audit-ready across different regulatory jurisdictions.

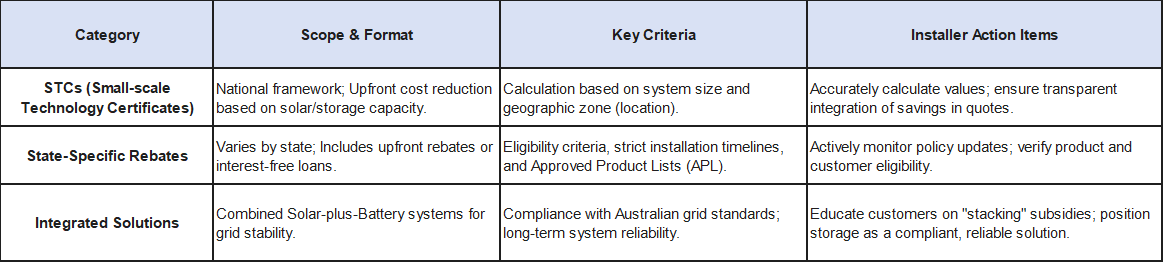

Australia Market: Navigating STCs and State-Specific Battery Rebates

In Australia, Battery Subsidies primarily revolve around the Small-scale Technology Certificates (STCs) framework combined with state-level battery rebate schemes. Installers must calculate STC values accurately based on system size and location, then integrate these savings transparently into customer quotations. State programs, such as interest-free battery loans or upfront rebates, vary significantly in eligibility criteria, installation timelines, and approved product lists. Successful installers actively monitor state policy updates and educate customers on combining STCs with local rebates. By positioning energy storage as part of a compliant solar-plus-battery solution, installers can maximize subsidy benefits while ensuring long-term system reliability in Australia’s demanding grid environment.

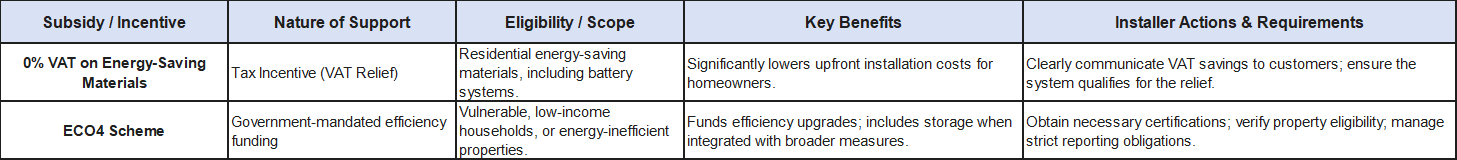

UK Market: Leveraging 0% VAT and the ECO4 Scheme for Energy Storage

The UK’s Battery Subsidies landscape in 2026 is driven less by direct rebates and more by tax incentives and efficiency schemes. The continuation of 0% VAT on residential energy-saving materials significantly lowers upfront battery system costs. In parallel, the ECO4 scheme supports vulnerable households by funding energy efficiency upgrades, including energy storage when integrated with broader measures. Installers must understand property eligibility, installer certification requirements, and reporting obligations under ECO4. Clear customer communication around VAT savings and scheme limitations helps avoid misunderstandings. Installers who package compliant battery systems with professional subsidy guidance gain a strong advantage in the UK market.

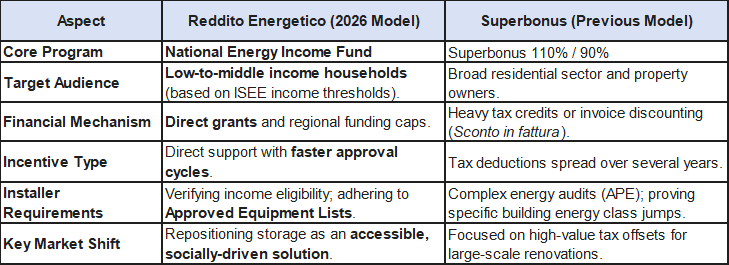

Italy Market: Moving from Superbonus to the New “Reddito Energetico” 2026

Italy’s transition away from the Superbonus has reshaped the Battery Subsidies framework. The emerging “Reddito Energetico” model in 2026 focuses on targeted support for low- and middle-income households adopting renewable energy and storage systems. Installers must adapt by verifying household income thresholds, regional funding caps, and approved equipment lists. Unlike previous tax-credit-heavy models, the new structure emphasizes direct support and faster approval cycles. Installers who understand these changes can reposition energy storage as an accessible, subsidized solution while ensuring compliance with evolving national and regional regulations.

Automation and Tools: Streamlining the Subsidy Application Process for Higher Efficiency

Managing Battery Subsidies manually increases administrative burden and delays project execution. Advanced energy storage systems with integrated monitoring, standardized documentation, and remote diagnostics simplify subsidy applications. Hicorenergy’s residential and commercial energy storage products are designed with compliance, traceability, and installer efficiency in mind. Features such as standardized certifications, wide inverter compatibility, and remote monitoring reduce after-sales risks and support smoother subsidy audits. By combining automation tools with reliable battery systems, installers can handle more projects simultaneously while maintaining high approval success rates and customer satisfaction.

In summary, Hicorenergy provides residential, C&I, and lithium-ion energy storage solutions designed for long service life, high efficiency, and compliance—helping installers maximize Battery Subsidies while delivering reliable energy value to customers.

For professional support and product inquiries:

Email: info@hicorpower.com

WhatsApp: +86 181-0666-3226